wake county nc sales tax calculator

2020 rates included for use while preparing your income tax. Learn about listing and appraisal methods appeals and tax.

North Carolina Sales Tax Calculator Reverse Sales Dremployee

What is the sales tax rate in Wake County.

. The total sales tax rate in any given location can be broken down into state county city and special district rates. Choose Avalara sales tax rate tables by state or look up individual rates by address. Overview of Wake County NC Taxes.

Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. Discover Helpful Information And Resources On Taxes From AARP. The sales tax rate for Wake County was updated for the 2020 tax year this is the current sales tax rate we are using in the Wake.

This is the total of state and county sales tax rates. The December 2020 total local sales tax rate was also 7250. The latest sales tax rate for Wake Forest NC.

Our tax preparers will ensure that your tax returns are complete accurate and on time. The current total local sales tax rate in Wake County NC is 7250. Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. This includes the rates on the state county city and special levels. North Carolina has a 475 sales tax and Wake County collects an.

This rate includes any state county city and local sales taxes. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Our free online North Carolina sales tax calculator calculates exact sales tax by state county city or ZIP code.

The calculator should not. Wake County in North Carolina has a tax rate of 725 for 2022 this includes the North Carolina Sales Tax Rate of 475 and Local Sales Tax Rates in Wake County totaling 25. Wake Forest is located within Wake County.

This calculator is designed to estimate the county vehicle property tax for your vehicle. Ad Reduce complexity by outsourcing the preparation and filing of sales tax returns to Sovos. A single-family home with a value of 200000.

The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200. How to calculate taxes Tax rates are applied against each 100 in value to calculate taxes due. Choose Avalara sales tax rate tables by state or look up individual rates by address.

The average cumulative sales tax rate in Wake Forest North Carolina is 725. DEC 20 2020. Search real estate and property tax bills.

The sales tax rate for wake county was updated for the 2020 tax year this is the current sales tax rate we are using in the wake county north carolina sales tax comparison. Pay tax bills online file business listings and gross receipts sales. The minimum combined 2022 sales tax rate for Wake County North Carolina is.

Wake County NC Property Tax Calculator. Not in North Carolina. Sales tax in Wake County North Carolina is currently 725.

Wake county nc sales tax calculator. Please enter the following information to view an estimated property tax.

![]()

Prepared Food Beverage Tax Wake County Government

Sales Taxes In The United States Wikipedia

Real Estate Wake County Government

Virginia Sales Tax Rates By City County 2022

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

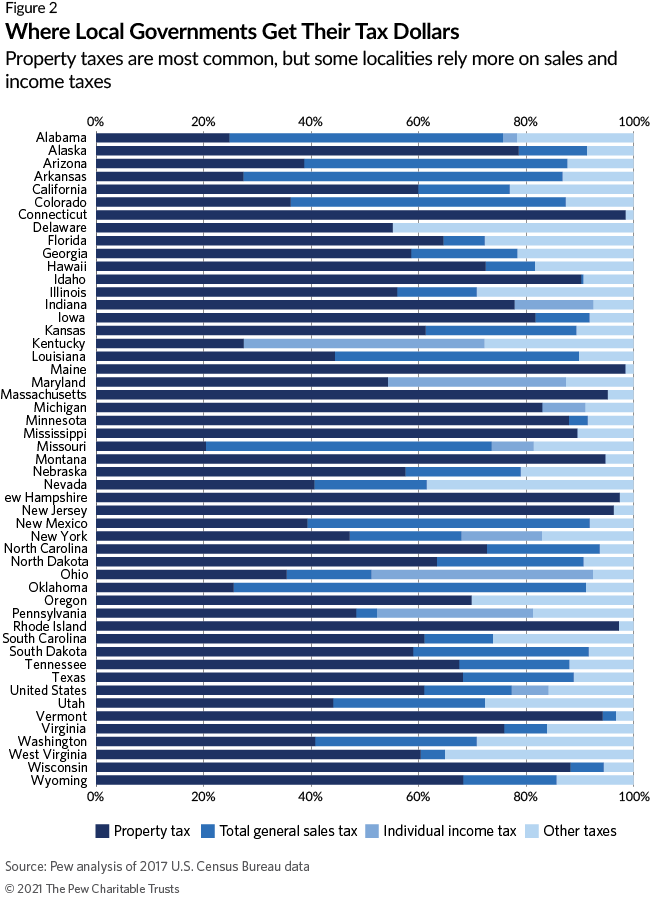

Local Tax Limitations Can Hamper Fiscal Stability Of Cities And Counties The Pew Charitable Trusts

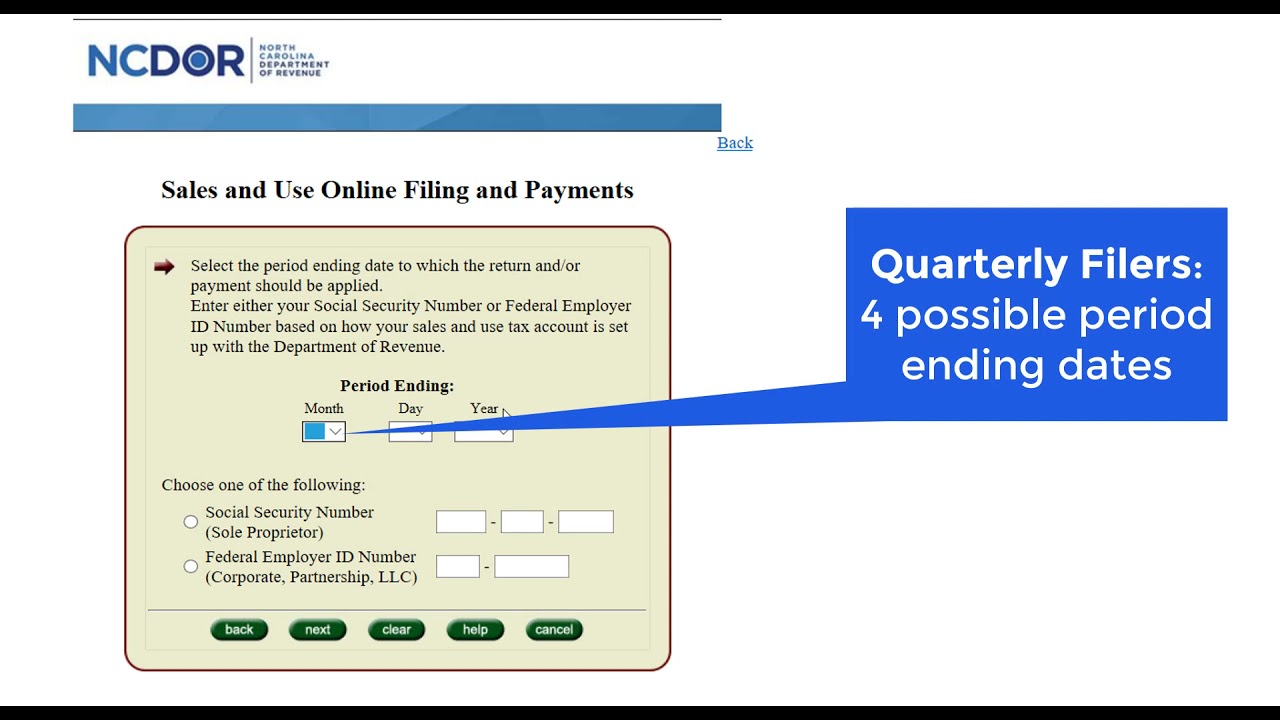

Online File Pay Sales And Use Tax Due In One County In Nc Youtube

Why Doesn T North Carolina Have A Tax Free Weekend Wcnc Com

Taxes Wake County Economic Development

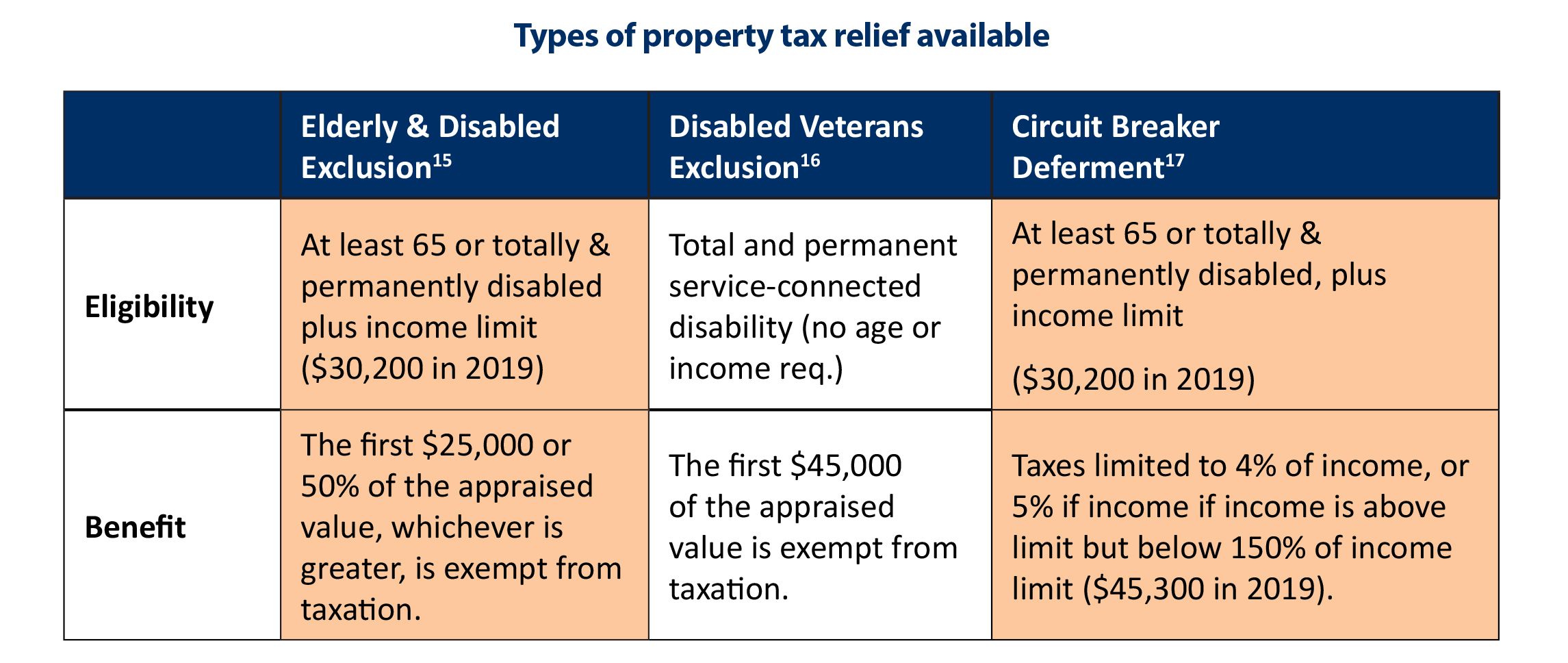

N C Property Tax Relief Helping Families Without Harming Communities North Carolina Justice Center

Harnett County Nc Property Taxes How Much Does It Cost

Estate Planning 101 Wake County Government

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

February 2022 S Median Sales Price For Wake County Real Estate Shatters Record High At 420 000 Up 10k From January 2022 Wake County Government

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

North Carolina Sales Tax Rate Rates Calculator Avalara

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

North Carolina Sales Tax Calculator Reverse Sales Dremployee

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue