tax strategies for high income earners canada

This bracket applies to single filers with taxable income in excess of 539900 and married couples filing jointly with taxable income in excess of 647850. 6 Tax Strategies for High Net Worth Individuals.

Raising The Capital Gains Tax Would Soak More Than Just The Rich New Analysis Suggests Financial Post

Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds 200000.

. Tax Planning Strategies for High-income Earners. Wealth preservation tax code strategies to reduce income and capital gains tax. Return the corporate tax rate to 28 percent from the.

Here are some of our favorite income tax reduction strategies for high earners. An overview of the tax rules for high-income earners. Starting Oct 16th 2017 the Federal Government declared they were reducing small business.

Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your. Otherwise attribution rules kick in and the. Here are 50 tax strategies that can be employed to reduce taxes for high income earners.

Qualified Charitable Distributions QCD 4. High-income earners like senior executives who accumulate a large concentrated. Chen notes that the Income Tax Act in Canada requires that the spouse receiving the funds must keep the funds in the RRSP account for three years.

This article highlights a non-exhaustive list of tax. 50 Best Ways to Reduce Taxes for High Income Earners. Converting some of your retirement account funds to a Roth is one of the most counter-intuitive tax strategies for high-income.

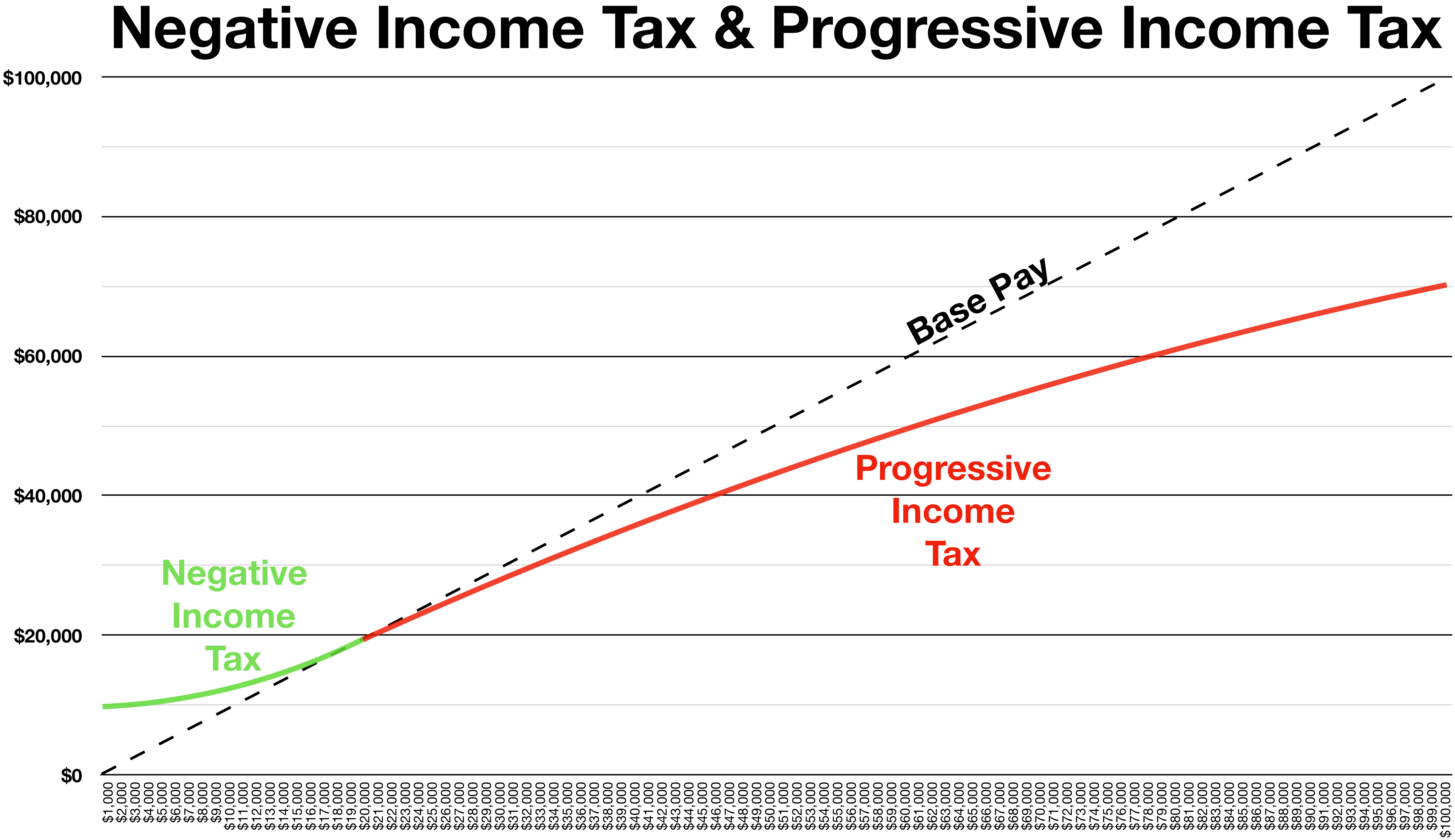

Eliminate the 20 percent long-term capital gains tax rate and replace it with the 396 percent ordinary income tax rate for high earners. Use Roth Conversions Wisely and Regularly. Tax Guide for Seniors - Publication 554 For.

The growth is tax free. How to Reduce Taxable Income. The contributions are tax deductible.

We will begin by looking at the tax laws applicable to high-income earners. If you are an employee. Tax Tips For Earners In 2020 Loans Canada from loanscanadaca.

High-income earners make 170050 per year. Mon - Fri. The first way you can reduce your taxable income and therefore your tax on that income is.

1441 Broadway 3rd Floor New York NY 10018. This is especially true for high-income individuals as they are generally subject to much higher tax rates than most people. Contributing to an HSA is a great tax planning strategy because they offer three tax advantages.

Publication Tax Reduction Strategies For High Income Earners Canada as without difficulty as review them wherever you are now. Luckily there are many tax strategies and planning opportunities. 5 strategies to minimize taxes for high income individuals.

Tax Strategies For High Income Earners 2022 Youtube

The Next Tax Shelter For Wealthy Americans C Corporations

Advanced Tax Strategies For High Net Worth Individuals Moneytalk

High Income Earners Need Specialized Advice Investment Executive

How To Reduce Taxes For High Income Earners In Canada Qopia Financial

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

The Incidence Of Income Taxes On High Earners In Canada Gordon 2020 Canadian Journal Of Economics Revue Canadienne D 233 Conomique Wiley Online Library

Tax Planning Strategies For High Income Canadians

Tax Reduction Strategies For High Income Earners 2022

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

5 Tax Strategies For High Income Earners Pillarwm

Tax Planning For High Income Canadians Mnp

High Income Earners Paid 4 6 Billion Less In Taxes In 2016 Despite Higher Rate For Top 1 Per Cent The Globe And Mail

Advanced Tax Strategies For High Net Worth Individuals Moneytalk

Sandra Odgers Investment Advisor Tax Planning Publications

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy